KFORCE (KFRC)·Q4 2025 Earnings Summary

Kforce Q4 2025: Revenue Beats, EPS Misses on One-Time Costs — Stock Jumps 4%

February 2, 2026 · by Fintool AI Agent

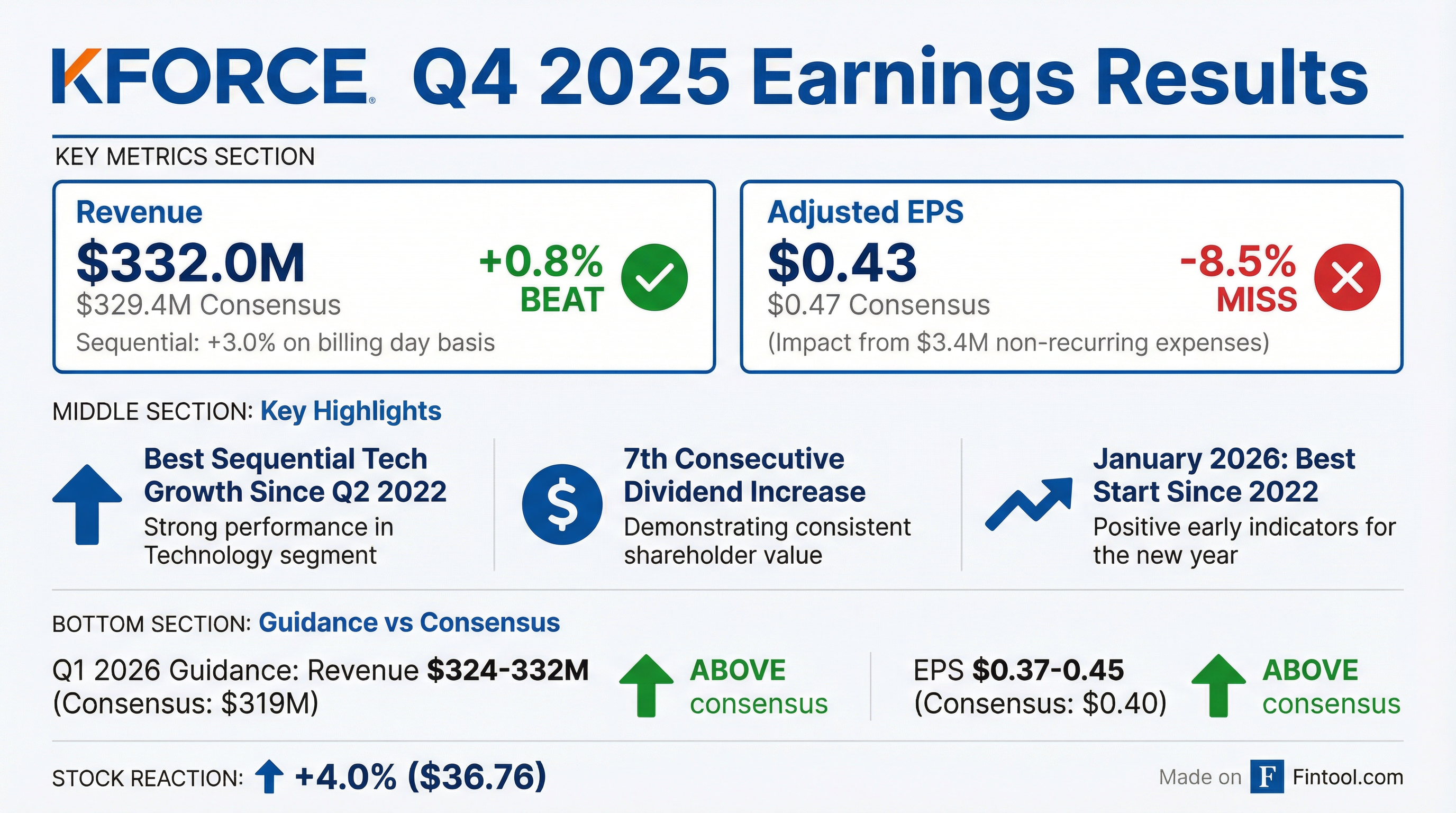

Kforce Inc. (NYSE: KFRC) delivered a mixed Q4 2025 quarter, beating revenue estimates by 0.8% while missing adjusted EPS by 8.5%. Despite the earnings miss — driven by $3.4M in non-recurring restructuring costs — shares jumped 4.0% as investors focused on the company's "best start since 2022" commentary and above-consensus Q1 2026 guidance.

Did Kforce Beat Earnings in Q4 2025?

Revenue: Beat by 0.8% — Kforce reported Q4 revenue of $332.0 million versus consensus of $329.4 million. On a billing day basis, revenue grew 3.0% sequentially, representing the highest sequential billing day growth in the Technology business since Q2 2022.

Adjusted EPS: Missed by 8.5% — Adjusted diluted EPS came in at $0.43 versus consensus of $0.47. GAAP EPS was $0.30. The shortfall reflects $3.4 million in non-recurring expenses related to organizational realignment activities ($1.2M) and operating cost streamlining including software write-offs ($2.2M).

What Changed From Last Quarter?

The narrative shifted meaningfully positive:

-

Tech Momentum Inflected: Technology Flex revenue grew 3.0% sequentially on a billing day basis — the strongest sequential growth since Q2 2022. This compares to -1.2% in Q3 2025 and -5.5% YoY declines earlier in the year.

-

January 2026 Strength: CEO Joseph Liberatore noted January results represent the company's "best start since 2022," with momentum from Q3/Q4 carrying over.

-

FA Flex Improving: Finance and Accounting Flex revenue grew 5.7% sequentially on a billing day basis, though still down 2.4% YoY.

-

Strategic Initiatives Advancing: Workday implementation for HCM and financials, India offshore delivery expansion, and "One Kforce" integration all progressing.

How Did the Stock React?

KFRC shares rose 4.0% to $36.76 following the release, trading near session highs. The stock has rallied ~50% off its 52-week low of $24.49 but remains well below its 52-week high of $55.40.

The positive reaction reflects the market prioritizing:

- Above-consensus Q1 guidance suggesting inflection

- CEO's bullish "best start since 2022" commentary

- Sequential growth reversing multi-quarter declines

What Did Management Guide?

Q1 2026 Guidance — Above Consensus Across the Board

Guidance contemplates "slight decline on the low end and slight growth on the high end" on a year-over-year basis, with 63 billing days vs. 62 in Q4 2025 and 63 in Q1 2025.

Key Financial Trends (8 Quarters)

Revenue declines have moderated from -11.4% in Q1 2024 to -3.4% in Q4 2025, with sequential trends now positive.

Full Year 2025 Summary

Segment Performance

Technology represents 92% of total revenue. Flex gross profit margin was 25.8%, down 50 bps sequentially but up 30 bps YoY.

Capital Allocation & Dividend

Seventh Consecutive Dividend Increase: The Board approved an increase in the quarterly dividend to $0.40 per share ($1.60 annually), up from $0.36. First Q1 2026 dividend payable March 20, 2026 to shareholders of record March 6, 2026.

2025 Capital Returns: The company returned $76.0 million to shareholders — $48.5M in buybacks and $27.5M in dividends — representing over 100% of operating cash flows.

Balance Sheet: Net debt increased to $66.4M (from $32.7M in 2024) on the credit facility, with free cash flow of $46.8M vs. $79.3M in 2024.

Key Management Commentary

"We are pleased to have delivered fourth quarter revenues that exceeded our expectations, which we believe are reflective of the continued build of momentum that we began to experience in the third quarter. The sequential Flex revenue growth we delivered in our Technology business represents the highest sequential billing day growth since the second quarter of 2022."

— Joseph J. Liberatore, President and CEO

"This momentum appears to be carrying over into the first quarter as January 2026 results represent our best start since 2022."

— Joseph J. Liberatore, President and CEO

Q&A Highlights

Client Behavior Shift

Management noted a meaningful change in client engagement patterns heading into 2026:

-

Holiday Retention: Clients held onto more consultants through the holidays than in the prior three years, and momentum "bounced right up to the holidays" with evaluations, interviews, and closed deals.

-

Fewer FTE Conversions: Conversions of consultants to full-time employees were down, signaling clients prefer flexible staffing over permanent hires amid macro uncertainty.

-

Record Client Visits: CEO Liberatore stated Q1 client visits are at "the highest levels that I can recall maybe in our firm history," indicating strong front-end demand indicators.

AI Thesis: The "Five Stages" Framework

Management drew parallels between AI adoption and the internet revolution, outlining a five-stage investment cycle:

- Initial exuberance

- Massive infrastructure investment

- Premature abandonment of legacy systems

- Realization of integration and modernization needs

- Return to balanced strategic investment and workforce transformation

"Reality is setting in and organizations that had started experimenting and playing with AI realize how much work they have ahead of them. The data and digital aspects are really what's turned up — in fact, our data practice and our digital practice are on a percentage basis our fastest growing practices."

— Joseph J. Liberatore, CEO

Pricing and Margins

- Tech Bill Rate Stable: Average bill rate in Technology has held steady at ~$90/hour for three years despite macro headwinds, supported by higher-skilled consulting mix offsetting offshore delivery pressure.

- FA Bill Rate Improving: F&A average bill rate improved to ~$53/hour, reflecting shift toward higher-skilled areas.

Long-Term Margin Target

CFO Jeff Hackman reiterated the company's profitability objective: approximately 8% operating margin at $1.7B revenue — more than 100 bps higher than when that revenue level was achieved in 2022. Even without revenue improvement, management expects operating margins to expand in 2026 due to cost actions.

India Offshore Acceleration

Demand for the Pune Development Center has accelerated over the last few months, supporting cost-effective multi-shore delivery for both consulting engagements and traditional staff augmentation.

What to Watch

-

Q1 Execution: Can Kforce sustain the sequential momentum through Q1? Management noted if trends continue, they could reach pre-holiday peak levels earlier than the typical end-of-March, setting up strong Q2 momentum.

-

Data & Digital Demand: These are the fastest-growing practices on a percentage basis — watch for continued momentum as enterprises lay the foundation for AI adoption.

-

Margin Rebuild Path: Operating margins should expand in 2026 even without revenue growth, with $7M (~$0.30/share) annualized savings from Q4 actions. Long-term target of 8% at $1.7B revenue provides a clear benchmark.

-

Tax Rate Headwind: 2026 effective tax rate expected at ~29% vs. 26% in 2025, driven by work opportunity tax credit expiration and lower R&D credits from Workday implementation wind-down.

-

Direct Hire Dynamics: Small/mid-size businesses are getting more active, but large enterprises slowed direct hire in H2 2025 — watch for any shift in conversion trends.